FI and sustainability

FI has a roadmap for its work with sustainable finance. It sets out three goals that will guide our work through 2025. We will base this sustainability work on FI’s mandate, the regulations related to sustainable finance, and the tools at our disposal as a supervisory authority.

FI's mandate provides the direction

Since 2019, FI's overarching and traditional mandate – to safeguard financial stability, consumer protection and well-functioning markets – also includes a responsibility to ensure that the financial system contributes to sustainable development. We are fulfilling this new assignment by allowing a sustainability perspective to influence how we perform our original assignments.

FI is also the responsible supervisory authority for a number of new regulations related to sustainable finance. Our work will also be based on the tools that we have at our disposal as a supervisory authority.

Roadmap for sustainable finance

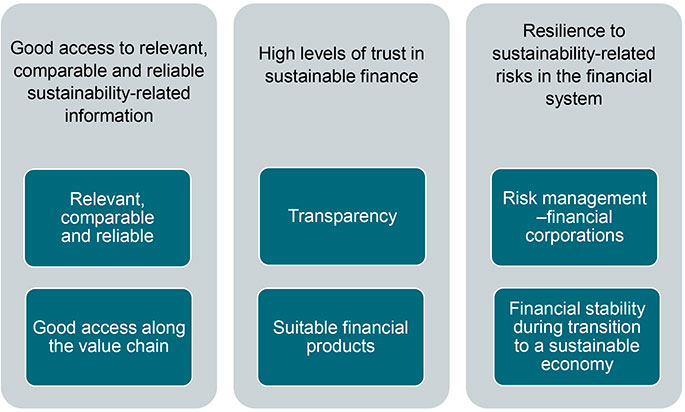

FI's roadmap contains three goals that will be our top priority in our work through 2025 to promote sustainable finance:

- good access to relevant, comparable and reliable sustainabilityrelated information,

- high levels of trust in a sustainable finance market,

- resilience to sustainability risks in the financial system.

The roadmap also contains a number of prioritised actions that will guide us in our work:

- implement new rules, maintain dialogue and communication

- integrate sustainability factors in our supervision

- forward-looking analysis tools

- prevent greenwashing

- improve access to sustainability-related information

- improve disclosures regarding sustainable financial products

- prevent financing of money laundering and terrorism

- active contribution to international policy work.

Last reviewed: 2025-01-16